Conservative Senators are tinkering with the Trudeau Government’s proposed tax reductions aimed at the middle class.

The Senate is proposing changes that would give greater savings to people making 45 thousand, 60 thousand and 80 thousand dollars a year.

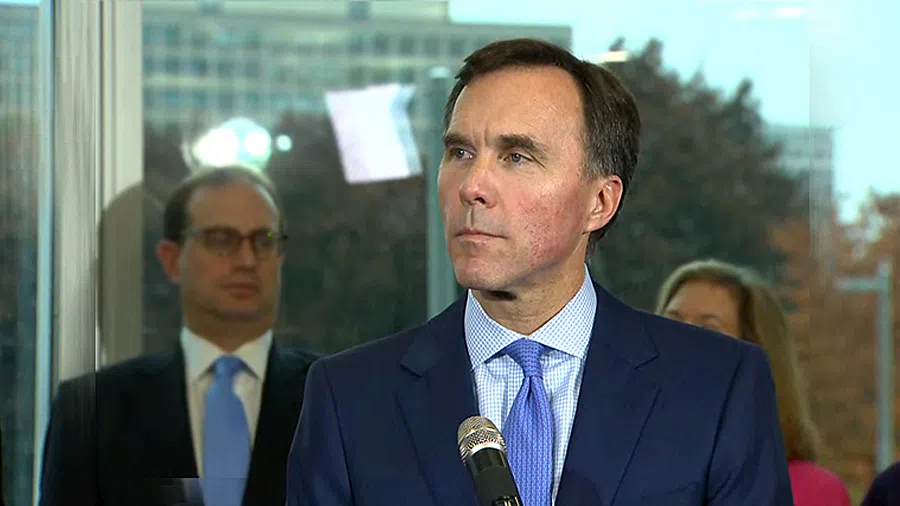

Federal Finance Minister Bill Morneau indicates the government remains committed to what it campaigned on to give the middle class a financial helping hand and has indicated these proposed changes won’t fly.

Canadians with taxable incomes of $48,000 would get a tax saving of $190 under the changes being proposed by a Senate committee. That would be more than double the $81 proposed by the Trudeau Government.Ssomeone who earns $60 thousand a year would save $570 a year in taxes as opposed to $261 and if you earn $80 thousand annually, you would save $1 thousand instead of $750.

If the Senate approves the changes, they would go back to the House of Commons.