Atlantic Canada’s growth is expected to slow next year but still outperform the rest of Canada. That’s according to the Atlantic Provinces Economic Council (APEC), which made the prediction at a presentation delivered at the Hilton Saint John Trade and Convention Centre on Tuesday.

“In Canada, the economy has rebounded strongly from the pandemic, but looking to the near future the outlook is not quite as pleasant,” said APEC senior policy analyst Fred Bergman.

“Economic growth is likely to stall early next year due to persistent inflation and high interest rates stalling investment and consumer spending. In the second half of next year we expect inflation to notably cool and the bank of Canada to start lowering its key policy rate. This could lead to a slow pickup of economic growth in the later part of next year.”

Bergman acknowledged the possibility of a recession but said that, due to high amount of savings by Canadians, it likely won’t be as deep as 2008.

He told the crowd that he expects the Atlantic economy to fare better than the rest of Canada in 2023 due to increased migration to the region both from abroad and from within Canada.

But the Atlantic Canadian economy is expected to grow more slowly next year, with GDP growth slowing from 2.7 percent to 1.2 percent. The exception will be Newfoundland, which will benefit from high oil prices and increased production – notably the West White Rose offshore oil project.

Inflation averaged a little over seven percent so far this year, Bergman said. Even with the increase in interest rates, inflation is not expected to come back down to two percent until the end of 2024 and key policy interest rates are anticipated to stay above three percent until early 2024.

Record immigration

There were about 8,400 people who immigrated to New Brunswick from abroad in the past year and 28,000 who moved to Atlantic Canada. That number is expected to increase to 30,000 in 2023. New Brunswick also picked up an additional 10,000 new residents from the rest of Canada, most notably from Ontario.

“Over the last year, Atlantic Canada had record population growth — the highest pace we’ve seen since Confederation in 1867,” Bergman told the crowd.

Still, labour shortages continue to present a problem for Atlantic Canadian businesses, especially as the population ages.

Sectors across Atlantic Canada experienced two percent increases in labour shortages from 2019 to 2022, with some industries being hit harder than others. For example, in New Brunswick, accommodation and food services experienced a 12.6 percent job vacancy rate, followed by construction at 8.5 percent, arts and entertainment at seven percent, and transportation at six percent.

“The current tight labour market should loosen a little because of the economic slump,” Bergman said. “However, it doesn’t mean labour shortages are going to totally dissipate and disappear. There’s an increasing share of our workforce that’s going to be retiring in the coming years.”

“In our research we showed that, in 2020, for every 10 people retiring we only had seven new young workers entering the workforce, whereas in 1990, we had 20 new workers for every 10 people retiring. That’s the gap that we’ve got to close,” Bergman said.

“We have to attract and retain more immigrants. We also have to increase labour force participation of our underrepresented groups.”

Wage growth

Not only attracting but retaining migrants is going to be an important priority for New Brunswick businesses.

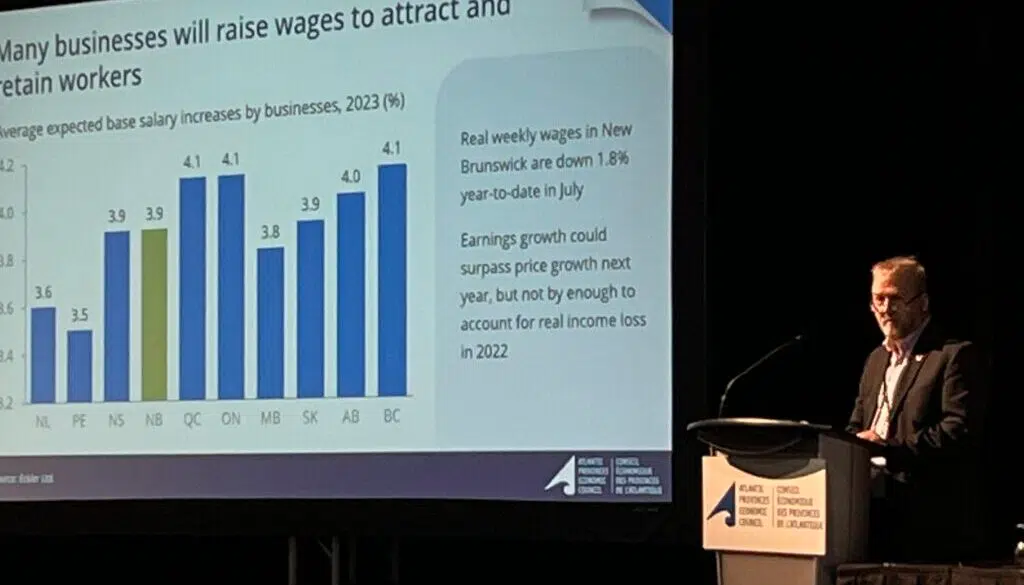

Attendees were surveyed about their expectations for wage growth over the next year. Forty percent of respondents clocked an anticipated 2-4 percent wage increase in 2023, followed by 33 percent who guessed they would need to increase wages by 4-6 percent in order to retain employees.

Nationally, wage increases were estimated to be between 3.5 and 4.1 percent, with New Brunswick businesses anticipating a 3.9 percent wage increase for their employees.

“We’ve had senior roles that have been open for two years,” says Lori Weir, CEO of Four Eyes Financial, a wealth management compliance software company. “The competition for talent is international and it’s expensive.”

“The cost for talent is going up,” she said. “The only thing we can do to compete at sometimes double the wage is to make it very compelling work at Four Eyes, to be in a place where you have a sense of community.”

Automation and remote work options may help address labour shortages but the learning curve is steep to get these technologies up to speed and implemented in Atlantic Canada.

Increase in cargo and exports

Locally, however, New Brunswick has made great strides in the past year regarding exports.

“New Brunswick’s international exports have increased by one-third year-to-date by the end of September 2022,” said Bergman. That’s largely due to increases in demand from the U.S. for cars and French fries. But that growth is expected to slow in 2023.

Still, the Port of Saint John is making strides to increase its already record year for cargo volume in 2022.

“An $84-million investment in the Port of Saint John’s supply chain will help increase container capacity 146 percent between 2023 and 2025,” Bergman said.

“These investments by the federal and provincial governments, JD Irving Limited, and Port of Saint John are equally split between container cargo capacity, and rail infrastructure.”

The Port of Saint John is adding two additional cranes next year and one extra berth. Both should go online in the spring of 2023. The investment for the berth is an estimated $205 million from both the provincial and federal governments.

These two additional cranes will help unload two container vessels simultaneously and they’ll be able to unload container ships carrying up to 10,000 twenty-foot-equivalent units.

All of these new investments will increase container throughput capacity at the port from 150,000 TEUs, a record the port hit in September, to 325,000 TEUs next year. However, containerized cargo capacity may be higher than the actual amount of throughput that goes through the port.

Investments in green energy and meeting the 2050 carbon emission deadlines being set by the federal government was also noted as a challenge Atlantic Canadian businesses are facing.

Alex Graham is a reporter with Huddle, an Acadia Broadcasting content partner.